Agenda-setting intelligence, analysis and advice for the global fashion community.

Beauty is on the hunt for its next big bang.

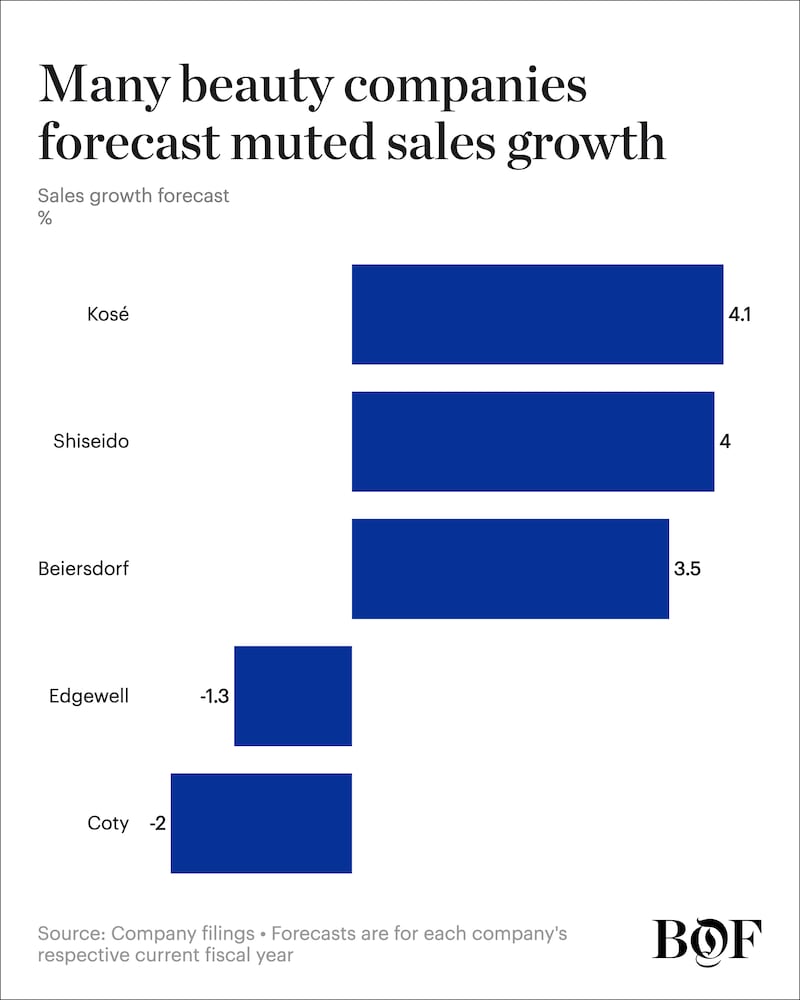

The industry has seen a deceleration in sales growth since last year, but pockets of dynamism like the buoyancy of the premium fragrance category and a few recent billion-dollar acquisitions assured investors. In the most recent earnings cycle, many of the world’s biggest firms are lowering their targets, and warning of further narrowing in sales.

“In cosmetics, sequentially, the consumer either isn’t coming back or is spending a bit less than they were,” said David Hayes, a managing director at the investment bank Jefferies.

On Tuesday, La Prairie and Chantecaille parent company Beiersdorf unexpectedly cut its full-year organic sales forecast to grow 3 to 4 percent on softer demand for mass brand Nivea. Conglomerates including Edgewell and Colgate-Palmolive have lowered their guidance, while Helen of Troy and E.l.f. Beauty have declined to issue any. Even the industry’s more resilient companies like L’Oréal and E.l.f. Beauty are seeing sales increases slimmer in growth than previous quarters.

ADVERTISEMENT

And for the better part of the year, firms like Coty, Shiseido, Procter & Gamble and The Estée Lauder Companies have announced restructuring programmes and plans to lay off thousands of workers globally.

The industry’s tried-and-true methods to boost earnings now feel fragile. Retailers from Sephora to Target are losing ground to Amazon and TikTok. Budding tariffs and increased competition in the world’s biggest beauty market, the US, are snarling up supply chains, while there’s also cooling in the can’t-be-beat fragrance and dermatological skincare categories. Nimble indie brands are also relentless in pace and speed. Olaplex’s chief executive, Amanda Baldwin, told The Business of Beauty that the premium hair care line is well aware of the need to stay competitive: “Regenerating the brand demand… is necessary to continue to get [Olaplex] back to growth,” she said last week.

Tarang Amin, chief executive of E.l.f. Beauty, told The Business of Beauty that despite his company’s continued growth, there is fear and uncertainty in every consumer category.

“We’ve been able to buck the [downward] trend, but certainly [the climate] weighs on long-term growth,” he said.

Crucially, many companies have also run out of road when it comes to price increases.

“It’s going to be tough in this environment to pass on even more pricing,” said Filippo Falorni, a managing director at the investment bank Citi, referencing the rising cost of living in many developed economies.

“This is not like the post-Covid era where everyone was getting back into beauty and these companies could increase the price of almost any product,” he said.

Growth Vectors Are Cooling

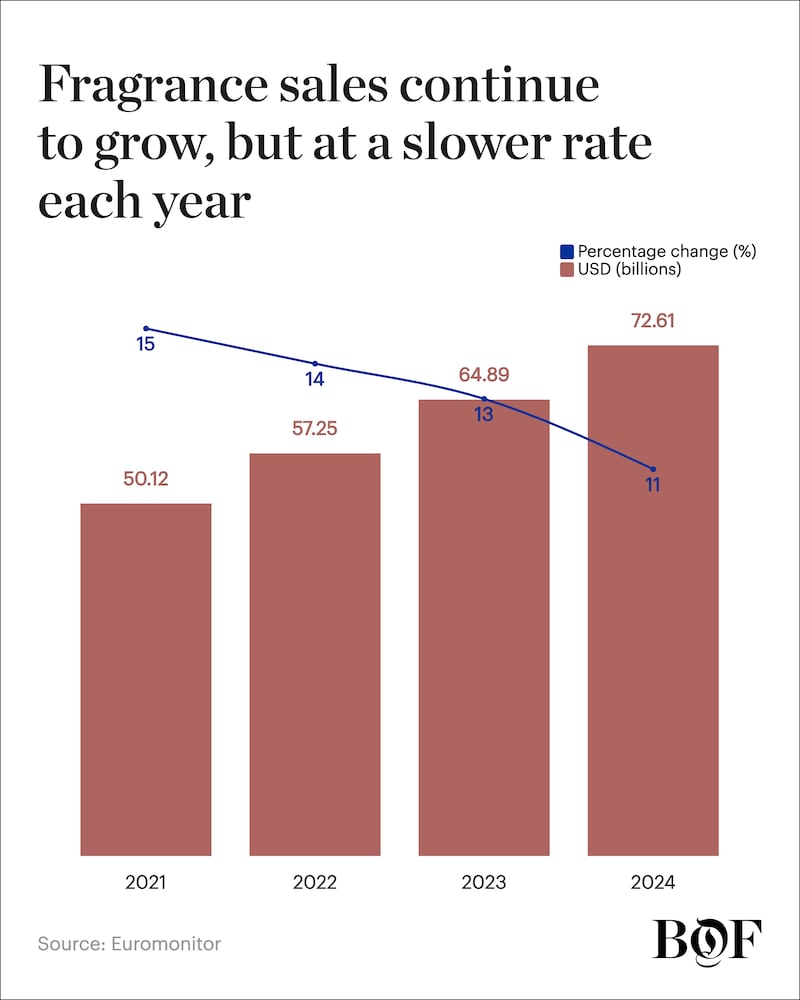

Two of beauty’s most reliably robust categories, fragrance and dermatological skincare, aren’t as resilient as they once were.

ADVERTISEMENT

L’Oréal’s Luxe division, which houses the likes of Valentino and Yves Saint Laurent Beauté perfumes, slowed 2 percent. LVMH’s beauty division, which includes Dior and Guerlain scents, eked out 1 percent growth. And Barclays investment bank expects Puig — which has around 70 percent of its sales come from fragrance — to see its sales growth to be at the lower end of its guidance of 6-8 percent this financial year. While demand remains high, analysts warn fragrance will not be the saving grace it once was, partially as companies lap tough comparison bases and consumer fatigue.

Many fragrances are also produced within the European Union and sold globally. Presently, EU imports are faced with a 15 percent tariff, though US president Donald Trump has warned it could spike higher if other desired covenants are not met. According to data from Euromonitor, the growth of the fragrance category has sequentially declined from 15 percent in 2021 to 11 percent in 2024.

In a July note, Barclays also highlighted softness in the American dermatological skincare market, a category that has become around 15 percent of the overall global skincare market. The declining popularity of drugstores, a key channel for dermatological skincare, has been a drag, as well as customer fatigue with premiumisation. L’Oréal’s chief executive noted in its August earnings call that mass brand Cerave, once white-hot and now slowing somewhat, is “still not as great as [it] would like,” despite a launch into haircare.

With a more pronounced deceleration in two of the industry’s biggest categories, underlying misses are becoming more visible — for Coty, fragrance helped conceal how much its mass brands like Covergirl and Bourjois were slipping.

The Channel Question

As more beauty shopping happens online, companies have to spend more on performance marketing and customer acquisition. According to Barclays research, around 17 percent of beauty sales happened online in 2024. While the cost of clicks on Meta platforms dropped around 10 percent in the first five months of the year, they remain high on platforms like Google, and turning a click into conversion is difficult.

“A company might be spending the same amount of money to get the customer [online], but the fickleness of the customer is going up seemingly all the time,” said Hayes, adding that the upfront costs and long-term retention costs for each customer can be more complex. Still, there are bright spots: Amin told The Business of Beauty that E.l.f. Beauty’s retention and traffic on TikTok has rebounded after dipping in the first quarter of the year, thanks to some attention-grabbing marketing stunts with trending creators and riffs on viral trends and renewed customer interest.

Many premium and mass brands including L’Oréal’s Lancôme and Estée Lauder Companies’ Origins, Clinique and Aveda have successfully launched on Amazon or TikTok Shop and count those channels as a boon. Long-term, however, maximising spend could become trickier as customers continually hunt for deals and prioritise promotions. It also complicates exclusivity agreements between brands and select retailers — premium brands would historically launch exclusively in a single retailer such as Sephora or Nykaa in the hopes of getting better placement and better conversion, but those bonds are under pressure as customer shopping habits become more fragmented.

Price Point Pressure

Many beauty companies that sell both mass and prestige products like L’Oréal and Estée Lauder Companies face something of a pincer effect. Customers are looking for value, putting pressure on brands such as Beiersdorf’s Nivea and Unilever’s Vaseline, both of which have introduced more premium offerings since 2020, while fast-moving brands like E.l.f. Beauty squeeze from the lower end of the pricing spectrum.

ADVERTISEMENT

As consumption slows, companies face the difficult choice of upping prices. Many public conglomerates are focussing on protecting their margins and profits rather than ratcheting up sales, which can work in the medium-term: L’Oréal missed top line expectations, but beat on profits, therefore its earnings impact was relatively low.

Positive signs are emerging from previously parched markets. China’s 6.18 shopping festival in June was better than expected, with Citi research finding that gross merchandise value increased around 10 percent with fewer discounts. L’Oréal saw growth in China for the first time in over five quarters while Procter & Gamble’s chief financial officer Andre Schulten noted on a call in July with analysts that the consumption had been “relatively strong”.

But all companies are facing a renewed call to sharpen their offerings and calibrate prices accordingly.

“Unless you’re actually giving people better value for money, you’re not winning. That’s the problem,” said Hayes.

Sign up to The Business of Beauty newsletter, your complimentary, must-read source for the day’s most important beauty and wellness news and analysis.