Agenda-setting intelligence, analysis and advice for the global fashion community.

Authentic Brands Group’s acquisition of Reebok in 2022 was a bit of a double-edged sword.

On one hand, Reebok found itself finally separated from Adidas. Already a long way from its glory days as Nike’s chief rival in the sneaker wars of the late 1980s when the German footwear giant acquired the Boston-based brand in 2005, by 2022 Reebok was a shadow of its former self. Adidas had long ago siphoned off top athletes and league deals, pigeonholing Reebok into niche categories like cross-training.

“Under Adidas, we were somewhat kind of stifled,” said Reebok chief executive Todd Krinsky, who had been with the company for more than three decades before Authentic appointed him to the top job. “It was dark days for us, man.”

But there wasn’t much reason to expect things to get better under the new owner. Primarily known as a holding company for distressed brands like Juicy Couture and Nautica, Authentic Brands Group’s usual strategy was to license faded but well-known names, while investments in product innovation, marketing and retail were typically lower priorities. At $2.5 billion, Reebok was by far Authentic’s biggest acquisition to date, and even in its diminished state, in a healthier position than many of its new portfolio-mates.

ADVERTISEMENT

Some feared Reebok could be reduced to a logo on cheap T-shirts and bottles of perfume. Authentic has hired third parties to operate and distribute Reebok in key markets. But it clearly has big ambitions for the brand, particularly in basketball. Reebok appointed retired NBA superstars Shaquille O’Neal and Allen Iverson as the president and vice president of basketball operations (Authentic owns O’neal’s name and likeness and has an endorsement partnership with Iverson; a Netflix series about their work to revive the brand debuted in June). Menswear designer Jide Osifeso was named head of basketball earlier this year, focusing on design and creative direction. The Engine A unisex hoops silhouette launched to much fanfare in January. WNBA star Angel Reese signed a multiyear deal in 2024 and her shoe is set to launch soon.

Authentic has also expanded distribution, inking a deal with JD Group in 2021 before the Adidas sale was formalised in 2022 to place Reebok in nearly 3,000 stores across the US and Europe. In June, Reebok entered into a partnership with Italy-based streetwear company Slam Jam to further bolster the brand’s global presence.

This expansion for Reebok seems to be paying dividends. In January 2024, Authentic chief Jamie Salter said the company had in the previous year hit $5 billion in annual sales, up from $1.6 billion in 2020 under Adidas, and planned on reaching $10 billion by 2027, according to Retail Dive.

Reebok’s success under Authentic hasn’t entirely quieted scepticism about the company’s ultimate plans for the brand.

“I think the game that’s being played is dangerous because of what we know about Authentic Brands Group,” Collab Lab founder and sneaker marketing expert Bimma Williams said. “I don’t believe they’re in it for the long haul. I don’t believe they have a bone in their body that’s like ‘We are diehard and bullish about basketball.’”

Reports surfaced that Authentic was in talks with Anta to potentially sell the brand off. Steve Robaire, Reebok’s executive vice president, denied the report and said Authentic is in the Reebok business for the long haul.

“There’s a massive opportunity for Authentic to continue growing into the sport ecosystem. Reebok is at the heart of our strategy,” Robaire said. “We’ll always look for the best opportunity to grow the brand, but we’re not looking to sell the brand at all.”

Why Reebok Is Pushing Basketball

Reebok’s focus on basketball shouldn’t come as a surprise. Founded in 1958, the brand mainly sold tennis and running shoes for its first three decades, but struck gold in the late 1980s and early 1990s with innovative silhouettes like the Reebok Pump, Iverson’s signature Question and Answer shoes, and O’Neal’s Shaqnosis. The performance basketball sector is again having a moment in fashion for the first time in years and the brand knows that. It believes that success in this arena could mean success culturally, too.

ADVERTISEMENT

“There’s such a crossover between what’s happening in basketball and what’s happening in culture from a lifestyle perspective,” Robaire said. “If you think about when Reebok was at its best, we were disrupting the sports base in basketball and that reverberated across the brand.”

With that in mind, the brand has been intentional in its approach to the sport. It isn’t working to scoop up every athlete that becomes available on the market and give them a signature shoe deal. Part of that is due to the brand’s selectivity, but many of basketball’s superstars already have deals secured with bigger brands.

Reebok is in a position where it has to do more with less. That’s why the brand’s partnership with Angel Reese has worked so well, Krinsky said. The brand was able to dedicate more resources to the development of her signature shoe and put it on a “fast track.” Reese’s shoe is set to officially release in three colorways on September 18. The brand first signed her to a deal in October 2023. Other brands in the marketplace are also using this playbook. Working with fewer athletes means dedicating more of the spotlight to establishing younger stars.

“When I want to go back and say, ‘Angel is popping right now. This could be a big opportunity — let’s accelerate it.’ We can all rally around that,” Krinksky said. “We don’t have the most, but we try to build icons.”

Whether basketball alone can propel Reebok to $10 billion in sales is an open question. Basketball shoe sales declined by five percent in 2024 and the market was down by 8 percent year-to-date in May 2025, according to Circana.

“I think Reebok can make a nice name for themselves in basketball. Certainly, Angel Reese is a hot property right now and that’s meaningful,” said Matt Powell, senior advisor at BCE consulting. “But the women’s basketball shoe business is very small compared to the men’s shoe business.”

The End Game

Despite the resources Authentic is pouring into Reebok, there are still those out there who are sceptical about the company’s belief in sport and its commitment to Reebok. Count Williams among them.

“Historically, we know that ABG doesn’t invest in brands in that way,” Williams said. “They’re very much … figuring out how to get as much profit out as possible without doing much investment in innovation and new demand creation.”

ADVERTISEMENT

While Powell said questions about Authentic’s intentions are fair, he said the company has a strong incentive to handle Reebok differently than its other brands.

“This is really the first thriving brand ABG has ever purchased,” Powell said. “It takes a different kind of management to run a thriving business rather than simply trying to squeeze the last bit out of a harvested brand.”

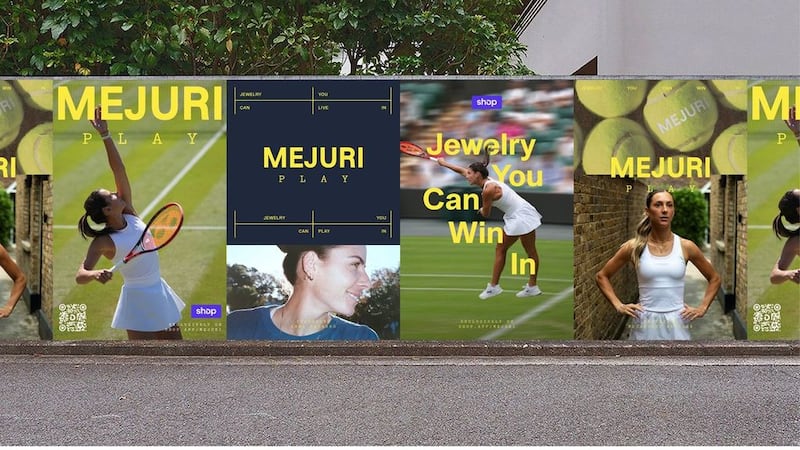

Robaire said Reebok is still charging ahead on sports overall as a category — not just basketball. That expansion is already underway. Reebok signed pro golfer Bryson DeChambeau in December and have launched golf footwear. The brand will also have a focus on “court sports,” Robaire said, including pickleball, padel and tennis. It will dive into soccer soon, which ties into an upcoming move for Reebok’s European headquarters back to London.

Authentic has been focused on “the strategy of ‘Let Reebok be Reebok,” Robaire said. “Be unapologetically us and get back into these verticals.”

Editor’s Note: This article was updated on 14 Aug 2025 to clarify Allen Iverson’s relationship with Authentic Brands Group.